The European Union, in March 2019, added UAE in their blacklist of non-cooperative tax jurisdiction, due to which Cabinet of Ministers passed resolution No. 31 of 2019 concerning Economic Substance Regulations. However, thanks to ESR, EU has now removed UAE from the blacklist.

Economic Substance Regulations are set in place to ensure that UAE entities that undertake certain activities are not used to artificially attract profits that are not commensurate with the economic activity undertaken in the UAE.

Who is subject to these regulations?

The regulations set out a reporting framework that applies to companies and/or licensees carrying out “Relevant Activities”. These activities are listed as follows:

- Banking Business

- Insurance Business

- Investment Fund management Business

- Lease – Finance Business

- Headquarters Business

- Shipping Business

- Holding Company Business

- Intellectual property Business (“IP”)

- Distribution and Service Centre Business

What are you required to do?

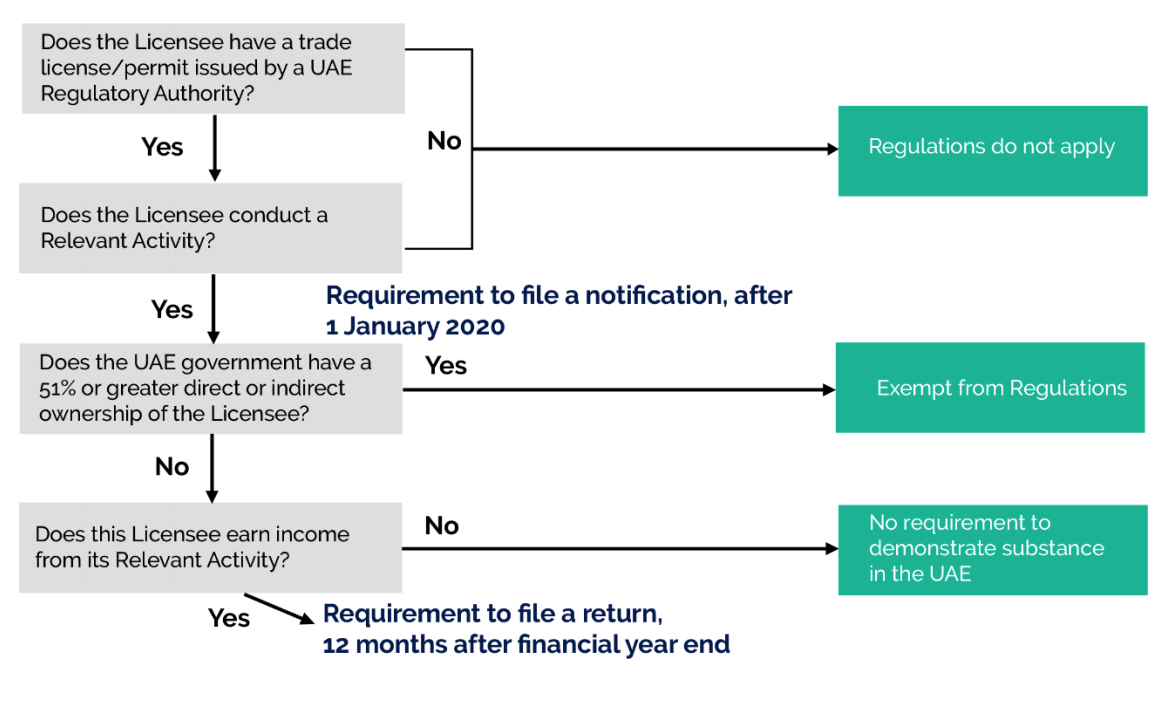

According to Article 8 Cabinet Resolution No. 31 by Ministry of Finance, a company and/or licensee, conducting one on the above ‘Relevant Activity’, will be required to do the following:

- Filing a Notification with the licensing authority and/or other regulatory authority where the company or licensee is registered and/or governed by.

- Submit an Economic Substance Report/Return with the licensing authority and/or other regulatory authority where the company or licensee is registered and/or governed by.

Notification

The notification must be filed each year at the time, form and manner approved by the relevant Licensing and/or Regulatory Authority starting from 1st Jan 2020. This notification will generally state:

- whether or not it carries out a Relevant activity;

- whether or not all or any part of the company’s gross income in relation to a Relevant activity is subject to tax in a jurisdiction outside of the UAE;

- the date of the end of its Financial Year.

- Additional details may be required by the Licensing and/or Regulatory Authority.

Economic Substance Return

If the company or licensee is generating income from said relevant activity/activities, they are required to submit the Economic Substance Return demonstrating that they pass the economic substance test. In order to pass the economic substance test the company or licensee would need to demonstrate the following:

Core Income Generating Activity/activities (CIGA) are conducted from within UAE

The entity will need to demonstrate that the relevant CIGAs have been undertaken in the jurisdiction, having regard to the level of income derived from the relevant activity. The CIGAs could be outsourced to a corporate service provider in the jurisdiction, subject to oversight by the entity (e.g. monitor and control)

Managed and directed from within UAE

The entity will need to be directed and managed in the jurisdiction with regards to the relevant activity (e.g. having board meetings with an adequate frequency, quorum of directors physically present at such meetings, the directors having the necessary knowledge and expertise to discharge their duties as directors, meeting minutes kept in the jurisdiction, etc.)

Adequate expenses, employees and assets have been deployed within UAE

The entity will need to have an adequate number of qualified employees, incur adequate expenditure in the jurisdiction proportionate to the level of activity and have adequate physical presence in the jurisdiction (e.g. office space, facilities, etc.). The Adequate Test is not designed to be prescriptive, and what is deemed to be adequate will be dependent on the particular facts and circumstances of the entity and the relevant activity in question.

The time frame, form and method for Notification and Economic Substance Return are subject to guidance issued by the relevant Licensing and/or Regulatory Authority.

Failure to report or incorrect reporting will attract administrative penalties starting from AED 10,000 and up to AED 300,000 and furthermore may result in the license being canceled by the Licensing regulatory Authority.

How can we help?

We can assist you with Initial Assessment to advise whether your activities fall within the scope of the law, Filing Annual Notification with the regulatory authority, Comprehensive Evaluation of the company’s current state of compliance and providing recommendations with regards to the Economic Substance Test and Submitting Economic Substance Return to the regulatory authority.

Let’s chat and check whether you fall under the umbrella of Economic Substance Regulations.