CHANGES IN ECONOMIC SUBSTANCE REGULATIONS

Economic Substance Regulations are set in place to ensure that UAE entities that undertake certain activities are not used to artificially attract profits that are not commensurate with the economic activity undertaken in the UAE. The recent amendments took place on 10th of August.

Who is subject to this law?

A company or licensee who is a juridical person; or an unincorporated partnership registered in the UAE, including Free Zone and Financial Free Zone and carries on a Relevant Activity.

Note: Natural persons, Sole proprietorships, Trusts and Foundations are now not subject to ES Regulations, thus not required to file the notification.

CHANGES IN DEFINITIONS AND TREATMENT

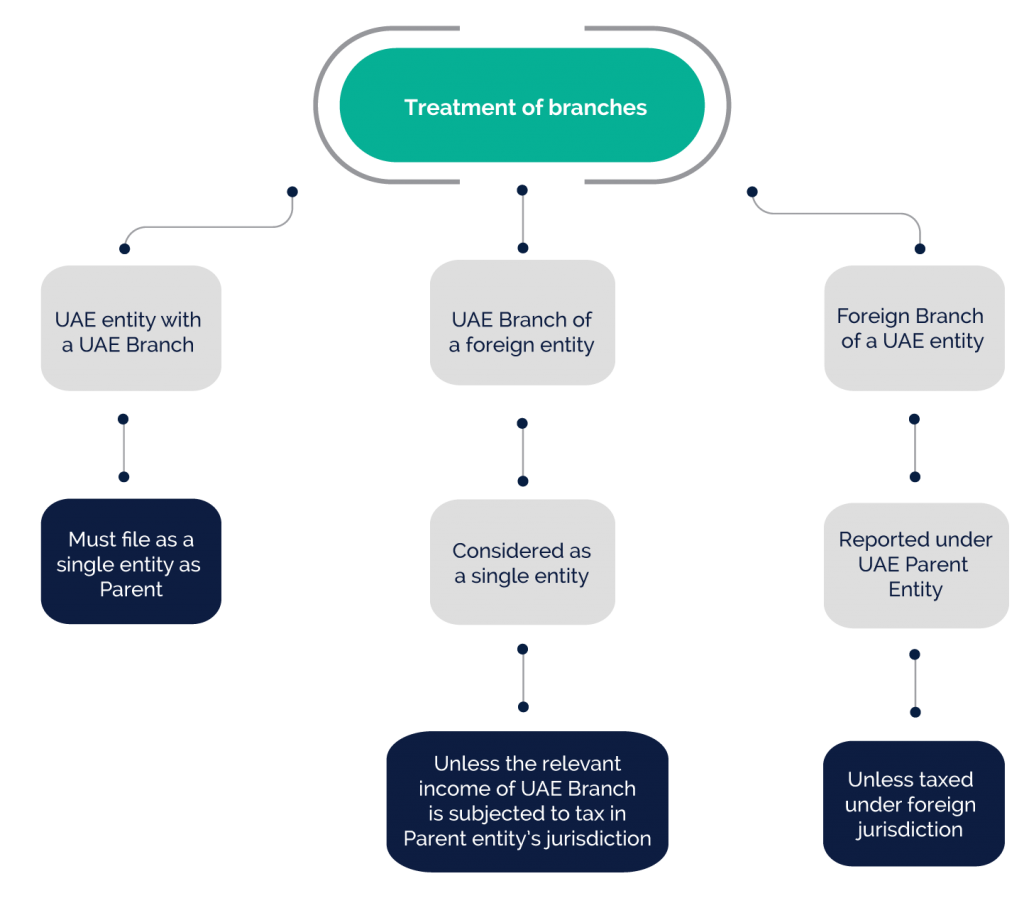

Treatment of Branches

Branches are to be treated as an extension of their ‘parent’ or ‘head office,’ as they do not have separate legal personalities.

- A UAE entity with a UAE branch must file as a single entity, reporting the Relevant Activities of itself and all its branches in one composite notification and/or ES Report.

- UAE branch of a foreign entity conducting a Relevant Activity would be considered as a separate entity unless the Relevant Income of the UAE branch is subject to tax in the jurisdiction of the foreign parent/head office.

- The income of the foreign branch of the UAE entity is not required to be consolidated if the income of the foreign branch is taxed outside the UAE.

Exemptions

An Entity can claim exemption from filing an ES Report under the following conditions;

However, to attain the Exemption status the entity is required to file an ES Notification with supporting documentary evidence.

- Entities that are tax resident outside the UAE

- Investment Funds and underlying SPVs/investment holding entities

- Entities that are wholly owned by UAE residents and that are not part of a multinational group and only carry out business activities in the UAE

- UAE branches of a foreign head office/parent whose relevant income is subject to tax in the jurisdiction of the foreign head office/parent

Entities directly or indirectly owned at least 51% by the UAE government are no longer specifically exempted.

An Exempted entity that fails to attain the Exempted status, shall be subject to all applicable provisions of the ES regulations.

Connected Persons:

An entity that is a part of the same group as the entity or an exempted entity.

Group:

Two or more entities related through ownership or control such that they are required to prepare consolidated financial statements for financial reporting purposes under applicable accounting standards.

Administration:

Ministry of Finance has appointed Federal Tax Authority as the “National Assessing Authority”, responsible for enforcing compliance of ESR which include:

- Assess whether an entity has met the ES Test

- Impose administrative penalties

- Hear and decide on appeals

- Carry out reporting requirements

- Exercise any other powers or functions as required in implementing ESR

Furthermore, MOF has also redefined or clarified terms such as UAE Residents, Parent Company, Ultimate parent Company, MNE group, Relevant Income, Consolidated Financial Statements, Unincorporated Partnership etc.

CHANGES IN THE SCOPE OF RELEVANT ACTIVITIES

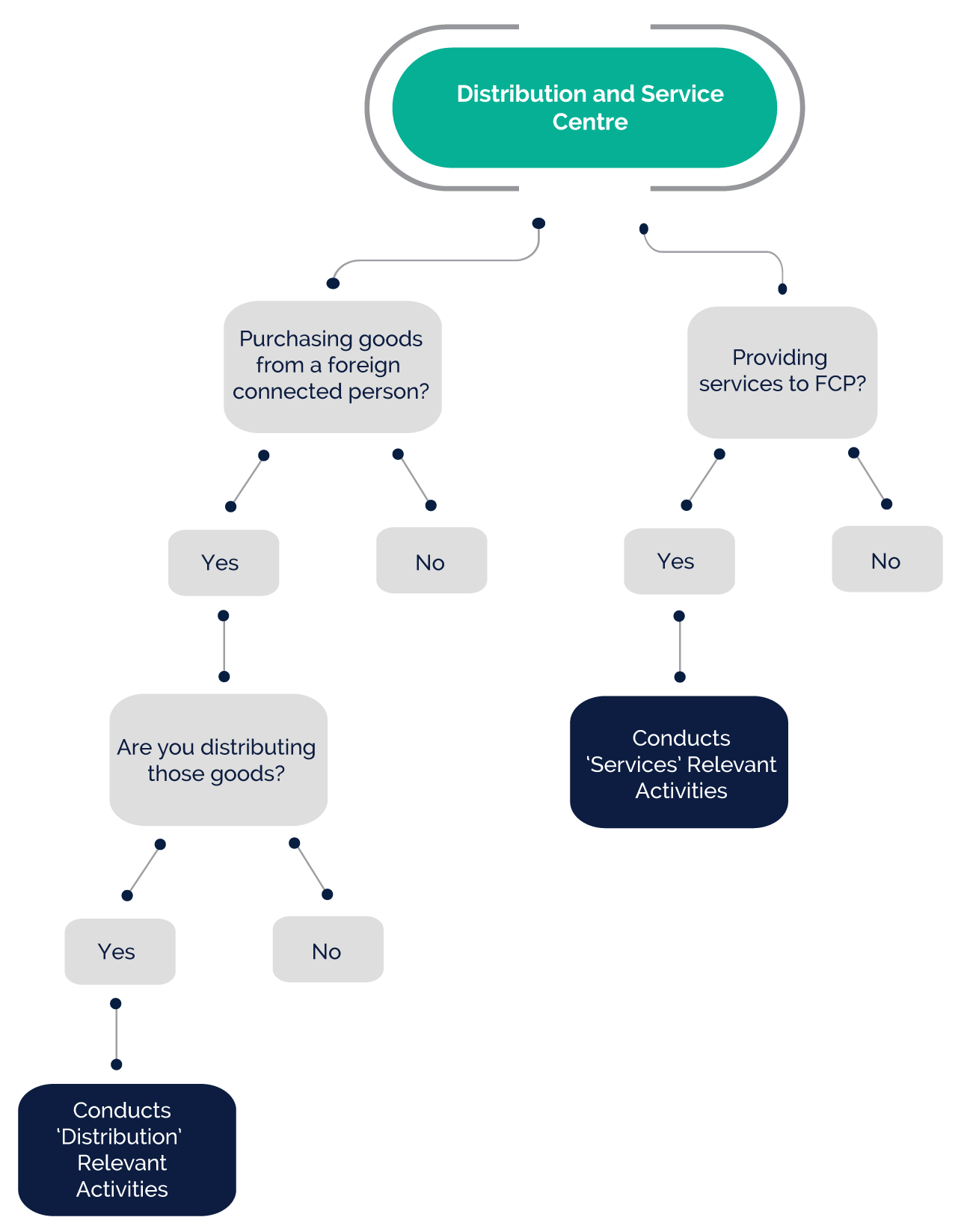

Distribution and Service Centre

A UAE entity is now considered engaged in a “Distribution” business if it:

- Purchases goods from a foreign connected person; and

- Distributes those goods.

It is not required to import and store goods in UAE any longer.

A UAE entity is considered engaged in a “Service Centre” Business if it provides consulting, administrative or other services to a Foreign Group Entity.

It is not required any longer for the respective business to be outside UAE.

High-Risk of Intellectual Property

The definition of a high-risk Intellectual Property licensee has been limited to an intellectual property business that meets all of the following conditions:

- The company did not create the intellectual property asset.

- The business acquired the intellectual property asset from either a Connected Person, or someone considering funding research and development by another person situated in a foreign jurisdiction.

- The business licenses has sold the intellectual property asset to a Connected Person or earns separate identifiable income from a Foreign Connected Person in respect of the use or exploitation of the intellectual property asset.

The second condition for qualifying a High-Risk IP has now been deleted.

Lease- Finance Business

A UAE entity is considered engaged in a lease-finance business if it offers credit or financing for any form consideration.

Cash Pools are now considered as Offering credits or financing now includes Cash Pool arrangements.

Holding Company Business

An entity is considered to be engaged in Holding Company Business if:

- Its sole function the acquisition and holding of shares or equitable interests in other companies;

and - Only earns dividends and capital gains from its equitable interests.

“Dividends” has now been defined to mean any distribution of profits to the holder of shares or equitable interest in another company or incorporated partnership.

Further, if real estate assets are used only for holding company business, and no other income is generated out of such assets, then the said entity would still be regarded as Holding Company Business.

SUBMISSION/RESUBMISSION OF ES NOTIFICATION

Licensees and exempted licensees must submit their notification on the Ministry of Finance portal after it goes live in the first week of December 2020. Those who have already submitted their notification directly to their Regulatory Authority will also have to re-submit via the Ministry of Finance Portal by 31st December 2020.

OTHER SIGNIFICANT CHANGES

- ES Notification must be submitted within six months from the end of Entity or Exempted Entity’s end of Financial Year. Entities which the ES Notification due date before the MOF Portal goes live or have already submitted their notification directly to their Regulatory Authority will have to submit/re-submit the same via the Ministry of Finance portal by the 31st of December 2020.

- ES Report must be filled by the entity falling within the scope of the ESR, which is not exempted and generates income from a relevant activity. The report must be filed within twelve months of the end of the Financial Year. If the ES Report is due before the MOF Portal goes live, an entity will have until 31st December to submit the report.

- Revised templates for ES Notification and ES report have been released by the Ministry of Finance, along with guidance on each of these.

- Entities may outsource activities which are not CIGAs to outside the UAE, e.g. outsourcing of back-office functions, IT, payroll, legal services, or other expert professional advice or specialist services provided.

- Board Members not required to be UAE residents but are required to be physically present in the UAE when taking the decisions and minutes of the Board Meetings must be recorded.

- MOF portal >is going to be live during the first week of December 2020.

- Penalties have now been fixed as below:

- Failure to submit ES Notification – AED 20,000

- Failure to provide accurate information – AED 50,000

- Failure to submit ES Report or meet ES Test – AED 50,000 for the first year and AED 400,000 for subsequent year

- The contents of the ES Reports have been clarified to include Financials Statements, amount of income, expense and assets held, number of employees, location etc. in relation to the relevant activity, declaration of meeting the ES Test among others.

WHAT’S NEXT

In light of the changes, all entities and exempted entities conducting a Relevant Activity must submit/re-submit an ES Notification via the Ministry of Finance portal, once it is live. The new deadline for the same is the 31st of December 2020.

Similarly, an entity may also be required to submit the ES Report by 31st December 2020. Financial Statements and other financial information, including other supporting documents, will be required as part of the ES Report.

We strongly recommend that all entities and exempted entities reassess their scope according to the new ESR regime in order to be ready to submit/re-submit the ESR Notification and the ES Report.

How can we help?

Our services, include Initial Assessment will guide you if your activities fall within the scope of the law, Filing Annual Notification with the regulatory authority, Comprehensive Evaluation of the company’s current state of compliance and providing recommendations with regards to the Economic Substance Test and Submitting Economic Substance Report to the regulatory authority.

Please contact us on esr@cztaxaccounting.ae to engage us for the above.

Let’s chat and see how you need to re-submit the ESR Notification.